Relief at last, for the underdog Tata Tele..DNA writes that American Tower Company (ATC) is believed to be the frontrunner among the bidders for investing in the tower firm of Tata Teleservices. Sources suggest a valuation of $2 Bn. from Tata Tele side.

Relief at last, for the underdog Tata Tele..DNA writes that American Tower Company (ATC) is believed to be the frontrunner among the bidders for investing in the tower firm of Tata Teleservices. Sources suggest a valuation of $2 Bn. from Tata Tele side.Thursday, April 3, 2008

American Tower closing in on Tata Tele stake

Relief at last, for the underdog Tata Tele..DNA writes that American Tower Company (ATC) is believed to be the frontrunner among the bidders for investing in the tower firm of Tata Teleservices. Sources suggest a valuation of $2 Bn. from Tata Tele side.

Relief at last, for the underdog Tata Tele..DNA writes that American Tower Company (ATC) is believed to be the frontrunner among the bidders for investing in the tower firm of Tata Teleservices. Sources suggest a valuation of $2 Bn. from Tata Tele side.Wednesday, April 2, 2008

Kapil Puri to sell off Sparsh stake

Kapil Puri, original promoter of Sparsh BPO, now owned by Blackstone controlled Intelenet, has decided to sell his residual stake of 12%.

Kapil Puri, original promoter of Sparsh BPO, now owned by Blackstone controlled Intelenet, has decided to sell his residual stake of 12%.Intelenet is awaiting regulatory approvals for the buyback. Puri intends to offer it all to intelenet, but incase of a spillover, will selloff to outsiders.

The sell off comes as he heads to develop Spanco's new BPO business after the may2007 no compete agreement has expired. Spanco's new BPO has already clocked Rs.35 Cr. of revenue

Intelenet, itself, has undergone a key change after buying out Sparsh. It went through a management buyout backed by PE firm Blackstone, which now owns 80% stake in the companyReports ET

Yatra invests 6.69 Mn in Saket for 26.05%

CNBC reports that Yatra Capital Ltd. has invested 6.69 Mn. euros for a 26.05 % in Saket Engineers Pvt. Ltd, a Hyderabad-based residential real estate development company.

CNBC reports that Yatra Capital Ltd. has invested 6.69 Mn. euros for a 26.05 % in Saket Engineers Pvt. Ltd, a Hyderabad-based residential real estate development company.Tuesday, April 1, 2008

JM buys rest of ASK in the broking JV

For JM the priority is "providing all financial products under one roof" while for ASK it means "focus more on the portfolio mangement and wealth advisory business in future".

ASK is awaiting for clearance from SEBI for its proposed asset management business.

Read ET

The Financial Crowd : Barclays & PFC

It is our belief that financial sector in India will become broader and deeper. We will report this in a section called The Financial Crowd. And we will cheer, when one is added in The Financial Crowd.

It is our belief that financial sector in India will become broader and deeper. We will report this in a section called The Financial Crowd. And we will cheer, when one is added in The Financial Crowd.Prozone sells 27% to Triangle Real Estate

ICICI prepares for a pre-ipo placement

ICICI is looking for to pre-IPO placement of equity and Global FIs such as Goldman Sachs, Morgan Stanley, JP Morgan, Credit Suisse and Nomura among others are in line.

ICICI is looking for to pre-IPO placement of equity and Global FIs such as Goldman Sachs, Morgan Stanley, JP Morgan, Credit Suisse and Nomura among others are in line.Apprantely 12-15 interests have been received and the deal will be sealed shortly.JP Morgan is the advisor for the pre-IPO placement while merchant bankers for the IPO have not yet been finalised. Sources believe I-Sec is valued at $7.5 Bn or 30,000 Cr, highest valuation for an I-Bank in India.

In February 2007, JM Financial had sold its 49 per cent stake in JM Morgan Stanley Securities for $445 million. The deal valued the entity at $908 million against DSP Merrill Lynch’s valuation of $1 billion, when Merrill bought out Hemendra Kothari’s 47 per cent stake in December 2005.

As reported by Business Standard

Friday, March 28, 2008

GS India buys another NBFC

Goldman Sachs will invest INR2 billion in the firm, through Goldman Sachs (Mauritius) NBFC LLC. The company plans to invest $7.5 million upfront and the balance $42.5 million in the next 24 months or so, the ET report said.

Goldman Sachs India expanion has stated goal of buying NBFCs.

Mallya Wants Heinken's 37.5% Stake

Heinken get's its stake in UB from Scottish & NewCastle (S&N) after the worldwide takeover of the British brewer. The heinken-carlsberg combined takeover of S&N for $15.4 Bn was announced in jan.

Mr Mallya says Heineken is not yet a shareholder in UB pending global transaction. “My business agreement was with S&N, and Heineken will have to renegotiate a charter of rights. I cannot speculate on the outcome of our discussions,” he added.

Heinken's beer business is a direct conflict with UB's Kingfisher beer. Heinken is also a leading shareholder in Asia Pacific Breweries, makers of Tiger Beer, another competition to Kingfisher. According to a banker S&N's business charter agreement is not transferrable to Heinken, and that's where Mallya's leverage will come from.

report from ET

SEBI's effort at decoupling

SEBI is proposing a margin payment from Institutional Investors from April 21 onwards.

Only Korea & Taiwan, of all Asian markets, require margins on high beta stocks.

The other spin to the story could be "Level Field", with retail,HNI and corporates having to pay 50% margin in the cash markets. With the proposed upfront T+1 margin collection, trading churn will reduce due to a portion of funds locked in margins. Is this an attempt to regulate financial markets to avoid slingers? May be. But the consequence is on risk, as conservative institutions like pension funds will be unwilling to pay advance for shares (margin payment on T+1, shares received on T+2).

The move is finding supporters (though from conservative folks ). Abhay Aima, Equity Head of HDFC says "Fair move, as more players come in & risk rises, market needs safeguards". Ved Prakash Chaturvedi, MD, Tata AMC says "This will reduce the amplitude of swings"

Kotak raises $440 Mn. for PE buys

Kotak Investment Advisory ltd. has raised $440 Mn. in its PE fund, taking the corpus to $1.4 Bn. It will continue it's focus on small & medium enterprises with a sweet spot in the range of $10-$30 Mn.

Kotak Investment Advisory ltd. has raised $440 Mn. in its PE fund, taking the corpus to $1.4 Bn. It will continue it's focus on small & medium enterprises with a sweet spot in the range of $10-$30 Mn.Thursday, March 27, 2008

TechWave : DataCenter Story Rolls On With Ctrl S

Ctrl S Data Centers, promoted by the Pioneer Group along with IDBI and Och-Ziff will set up 4 tier-IV data centers in India, investing $250 Mn. over 2-3 years.

Ctrl S Data Centers, promoted by the Pioneer Group along with IDBI and Och-Ziff will set up 4 tier-IV data centers in India, investing $250 Mn. over 2-3 years.Reported by ET

Monday, March 24, 2008

Red Fort Capital Plans $800 Mn. Real Estate Fund

Red Fort Capital will launch second in the series offshore fund, Red Fort India Real Estate Fund II next month with size of $800 Mn.

Red Fort Capital will launch second in the series offshore fund, Red Fort India Real Estate Fund II next month with size of $800 Mn.India on Kuwait Finance House's Radar

In this Bloomberg interview, CEO & GM of Kuwait Finance House Mr. Mohammed Sulaiman Al-Omar spoke about his plans for expansion into GCC & India-China markets. "We have to be there, whether or not they have the legal infrastructure and environment for Islamic banking. "

In this Bloomberg interview, CEO & GM of Kuwait Finance House Mr. Mohammed Sulaiman Al-Omar spoke about his plans for expansion into GCC & India-China markets. "We have to be there, whether or not they have the legal infrastructure and environment for Islamic banking. "Unitech to raise $500 Mn. from Lehman, Deutsche Bank

Lehman Brothers & Deutsche Bank will invest $500 Mn. in a Unitech SPV.

Lehman Brothers & Deutsche Bank will invest $500 Mn. in a Unitech SPV.A source suggests talks are in advanced stage for two commercial projects at Santa Cruz (Mumbai), for developable office space of 2Mn. Sq.Ft. The deal might close in 3 weeks.

This project will be a Unitech first in Mumbai, as the firm gets aggressive outside NCR, it's home zone.

Poor market conditions, and reducing funding options have been hard on realestate companies, but everyone loves a good deal.

Read the full story on ET

Bajaj Capital To Expand With $50 Mn.

Bajaj Capital is planning to raise $50 Mn. to expand it's network. Bajaj Capital is a 4 decade old investment advisory & financial planning firm owned by KK Bajaj.

Bajaj Capital is planning to raise $50 Mn. to expand it's network. Bajaj Capital is a 4 decade old investment advisory & financial planning firm owned by KK Bajaj.CRISIL to relook ratings

CRISIL is taking a re-look at ratings it assigned to debt issued by Indian Arms of 27 global financial institutions.

CRISIL is taking a re-look at ratings it assigned to debt issued by Indian Arms of 27 global financial institutions.Wednesday, March 19, 2008

PE Funds Waiting For Bargains

Mint here is first with a story on what was expected. PE deals down, but funds sure that companies are undergoing customary 3-4 month valuation adjustments before they line up for funds.

Also, Richard Heald, partner and MD of NM Rothschild and Sons. “During this period (of declining stock valuations), there will be more PIPE (private investment in public equity) transactions happening globally.”

“Deal prices remain high,” said John Levack, MD,Electra Partners Asia Ltd, "we will stay away from the Indian market and concentrate on deal opportunities in some other Asian markets in the short term".

Manu Punnoose, chief executive of PE fund Subhkam Ventures, added that “PE will get larger stakes (in pre-IPO deals)…but the holding time will be longer, around 3-4 years”. Nitin Deshmukh, head of Kotak Private Equity Group. “From a momentum play, we are getting into a value play.”

For more opinions on PE trends go to Mint Article

West Asia Pulls The Plug On Indian Power Projects

India Inc's effort to raise $6Bn. of funding from West Asian countries doesnt seem to be working.

India Inc's effort to raise $6Bn. of funding from West Asian countries doesnt seem to be working.HDFC to raise $1Bn. for buying HDFC bank equity

This Business Standard article reports HDFC raising $1 Bn. debt finance for it's stake purchase in HDFC Bank over 18 months.

This Business Standard article reports HDFC raising $1 Bn. debt finance for it's stake purchase in HDFC Bank over 18 months.Fresh equity issuance being ruled out, raising debt remains only recourse.

HDFC Bank acquired Centurion Bank of Punjab in an all-stock deal. Following this, HDFC Bank announced a private placement of equity to HDFC to enable the mortgage lender to maintain its stake at the current level of 23.3%. This entails an investment of almost $ 1 billion by HDFC.

I hope market liquidating financing mechanisms are avoided (e.g Orchid Chemicals)

Cairn raises 2534 Cr. with 5.37% stake sale

Cairn India, Indian arm of British O&G co. Cairn Energy decided to sell 5.37% to Malaysian Petronas, and Singapore-based Orient Global Tamarind Fund for Rs 2,534 crore ($625 million) for funding Capex.

Cairn India, Indian arm of British O&G co. Cairn Energy decided to sell 5.37% to Malaysian Petronas, and Singapore-based Orient Global Tamarind Fund for Rs 2,534 crore ($625 million) for funding Capex.Of the 113Mn. shares, 63.3 Mn shares go to Petronas & 49.7 Mn to Tamarind at Rs.224.3 each with a 1 year lockin. Funds will be utilised for capex at Mangala, Rajasthan, by next year.

For details of Cairn Operations read Business Standard.

No bidder for BKC Plot

MMRDA failed to get bids for two of the five plots that it auctioned in the Bandra-Kurla Complex (BKC).

For a commercial plot with a total developable area of 24,000 sq metres, the authority received around Rs 3.4 lakh per sq metre, only 14 per cent more than the reserve price of Rs 3 lakh per sq metre. Jet bought this bought as a sole bidder, to build its global headquarters. This is in mighty contrast to Rs 5.04 lakh per sq metre, the highest in the country to date, by Mumbai-based developer Wadhwa Builders for an MMRDA plot in November 2007.

Read BS article for more indication of sweet slowdown in realty.

Baring acquires 12% in Sharekhan

Baring Private Equity beat Merill Lynch to acquire 12% stake in Sharekhan for Rs.240 Cr.

Baring Private Equity beat Merill Lynch to acquire 12% stake in Sharekhan for Rs.240 Cr.Tuesday, March 18, 2008

National Investment Fund Declared as QIB

In what could be a slow begining towards an Indian SWF, a SEBI Press release included National Investment Fund (NIF), a fund set up by the Government of India vide Gazette Notification no. F. No. 2/3/2005-DD-II dated November, 23, 2005 in the definition of QIB.

In what could be a slow begining towards an Indian SWF, a SEBI Press release included National Investment Fund (NIF), a fund set up by the Government of India vide Gazette Notification no. F. No. 2/3/2005-DD-II dated November, 23, 2005 in the definition of QIB.Osian`s sells 9.4% stake to PE firm

Osian’s Connoisseurs of Art will sell 9.4 per cent stake to Abraaj Capital, Dubai-based PE firm, for Rs 80 crore. Arif Masood Naqvi, VCM & group CEO Abraaj, will join the Osian’s board.

Osian’s Connoisseurs of Art will sell 9.4 per cent stake to Abraaj Capital, Dubai-based PE firm, for Rs 80 crore. Arif Masood Naqvi, VCM & group CEO Abraaj, will join the Osian’s board.“Each has been buying from 2001 when shares started at Rs 30 and thereafter many placements every year at Rs 90, Rs 180, Rs 360, Rs 540, Rs 1,000, Rs 1,200 and Rs 1,600.”

MFI gets funding from Unitus

MokshaYug Access (MYA) has received funding of Rs 8.35 crore ($2 million) from a private equity fund Unitus Equity Fund L P (UEF), a Unitus entity to support MFIs in Asia & LatAm.

MokshaYug Access (MYA) has received funding of Rs 8.35 crore ($2 million) from a private equity fund Unitus Equity Fund L P (UEF), a Unitus entity to support MFIs in Asia & LatAm.MYA follows dual aim of developing rural entrepreneurial Self Help Groups & through them providing penetration to urban product & service providers.

Segments MYA focusses on are manpower, infrastructure and community participation- that can be used to increase efficiencies in the delivery of services such as dairy farming, livelihoods, healthcare and agribusiness to the rural households.

In 2006, it tied up with ICICI bank on a ‘partnership model’, through which the MFI identified the Self Help Groups (SHGs eligible for the loan. The bank then channeled the loan through the MFI, against 10 % of the amount held as security. This arrangement has been particularly cost-effective for lenders since loan identification, disbursement and recovery aspects are outsourced to MFIs who are know the local market.

PE-VC funds may be deemed FDI

According to a latest draft put up on RBI site for public comment, various classes of investors have been broadened with specific mention of PE & VC funds.

According to a latest draft put up on RBI site for public comment, various classes of investors have been broadened with specific mention of PE & VC funds.Form FC-GPR was revised in April 2007 by which remittance receiving Indian banks were required to obtain a KYC report on the foreign investor from the overseas bank remitting the amount.

Future Capital picks 70% in Godrej's rural initiative

Future Capital takes a step ahead in it's Rural Retail Masterplan with a 70% stake buyout from Godrej's Aadhar, a part of Godrej Agrovet, which will be spun off into an SPV. The Future Group will intially scale up Aadhar as supply chain of agricommodities. Aadhar may also become a distributor of financial products and consumer finance.

Future Capital takes a step ahead in it's Rural Retail Masterplan with a 70% stake buyout from Godrej's Aadhar, a part of Godrej Agrovet, which will be spun off into an SPV. The Future Group will intially scale up Aadhar as supply chain of agricommodities. Aadhar may also become a distributor of financial products and consumer finance.Monday, March 17, 2008

RBI Responds : FOREX Derivative Cap May Arrive

Local exposure mainly relates to interest rate and currency options and swaps while international investment includes credit derivative structures like credit-linked notes based on foreign currency loans and bonds raised by Indian companies abroad. RBI has asked banks to limit their capital market exposure to 40 per cent of their net worth, with direct exposure limited to 20 per cent.

As part of the proposed valuation norms, RBI could also ask banks to mark to market the derivative portfolio maintained in the held-to-maturity (HTM) category.

MTNL planning 50% stake offload in SunTel

In a case of wagging the dog by it's tail, MTNL, one of the shortlisted preferred bidder for Srilankan TelCo SUNTEL, is in talks for offloading 50% stake. As a 100% MTNL subsidiary SUNTEL would be subject to MTNL policies & practices and "SunTel is a profit making professionally run company, and MTNL doesnt want to change its working".

In a case of wagging the dog by it's tail, MTNL, one of the shortlisted preferred bidder for Srilankan TelCo SUNTEL, is in talks for offloading 50% stake. As a 100% MTNL subsidiary SUNTEL would be subject to MTNL policies & practices and "SunTel is a profit making professionally run company, and MTNL doesnt want to change its working".Tommy eyes 51% in Indian Business

Tommy Hilfiger, controlled by buyout private equity Apax Partners, is looking at direct ownership of its India operations by bringing in the maximum permissible 51% foreign direct investment (FDI) allowed in single brand retail.

Tommy Hilfiger, controlled by buyout private equity Apax Partners, is looking at direct ownership of its India operations by bringing in the maximum permissible 51% foreign direct investment (FDI) allowed in single brand retail.Saturday, March 15, 2008

Rahejas to raise Rs.530 Cr. from PE funds

New Delhi based Rahejas plan to raise Rs.530 Cr. from PE funds against 26% equity in their upcoming Gurgaon based engineering SEZ.

New Delhi based Rahejas plan to raise Rs.530 Cr. from PE funds against 26% equity in their upcoming Gurgaon based engineering SEZ.Quippo, Oil & Gas Service Sector and A New PE Hotbed

Quippo Oil & Gas, a subsidiary of Quippo Infrastructure Equipment promoted by SREI Infrastructure Finance, is planning to put Rs.2400 Cr. over next two years in buying onshore rigs, off-shore supply vessels and pipe-laying barges.

Quippo Oil & Gas, a subsidiary of Quippo Infrastructure Equipment promoted by SREI Infrastructure Finance, is planning to put Rs.2400 Cr. over next two years in buying onshore rigs, off-shore supply vessels and pipe-laying barges.RBI lifts PwC Ban

RBI lifted ban on PwC auditing banks & NBFCs.

RBI lifted ban on PwC auditing banks & NBFCs. Blackstone eyeing 10% in Ennore Foundries

Blackstone & Primus Capital are racing to acquire a 10% stake in Ennore foundries, now renamed Hinduja Foundries.

Hinduja's have decided to sell 10% of the their holding to raise $80-100 Mn. for partfinancing proposed capex.

The Sun Also Sets : PE deals falling through

The chill is moving deeper down the spine. This HT article points out that southbound market is taking a lot of valuations and some of the deals with it. Down.

The chill is moving deeper down the spine. This HT article points out that southbound market is taking a lot of valuations and some of the deals with it. Down.Friday, March 14, 2008

Reality Major's REIT plans delayed

IndiaBulls RealEstate and Unitech Ltd. have put their Singapore REIT plans on hold siting volatile market conditions. DLF may follow too.

IndiaBulls RealEstate and Unitech Ltd. have put their Singapore REIT plans on hold siting volatile market conditions. DLF may follow too.Unitech, IBREALEST & DLF had lined up a $0.5Bn,$1Bn & $1.5Bn. offer. Unitech and IBREALEST were exploring private placement, according to Business Standard. DLF too might delay the offer or go for $500Mn. private placement.

Indian developers, hit by soaring land costs and curbs on bank loans, are looking to tap REITs, which are not yet allowed in India, although draft guidelines for them were issued in December.

Read the article on Mint

New Mineral Policy

The National Mineral Policy (NMP) 2008, approved by the Cabinet last night, will reduce time delays in disposing off mining applications, boost FDI and "protect risk capital by providing automatic minning rights to miners".

The National Mineral Policy (NMP) 2008, approved by the Cabinet last night, will reduce time delays in disposing off mining applications, boost FDI and "protect risk capital by providing automatic minning rights to miners".Nexus India Capital invests in Organic Farming

Nexus India Capital has invested in Suminter India Organics, a leading contract farming company that focuses on organic produce for the textile and food industries.

Nexus India Capital has invested in Suminter India Organics, a leading contract farming company that focuses on organic produce for the textile and food industries.Promethean Raises India Focussed SPAC

The founders of the UK-listed investment firm Promethean have raised a $200 million special purpose acquisition company (SPAC) called Atlas Acquisition Holdings in the US, the largest ever SPAC targeted prominently at India.

Atlas Acquisition Holdings raised $200 million (Rs 800 crore) through the American Stock Exchange, the hub of global SPACs.

Though the SPAC does not mention in its offer document any geography or sector it would target, it is understood that Atlas is looking at businesses which have an India story. According to sources in the merchant banking industry, Atlas would eye a minimum deal value of around $500 million which could include funds raised by it as a SPAC and would be backed by debt. However, Atlas could even scout for bigger deals which could go upto $1 billion in enterprise value.

Atlas is led by its chairman & CEO James Hauslein, along with Gaurav Burman, part of the Dabur Group and also a key member of Promethean India. Promethean India is an AIM-listed investment firm with a corpus of $115 million, which targets Indian companies to pick small private equity stakes.

The funds raised by Atlas are large, even by US standards where SPACs size in general is around $100 million or lower. As per the data compiled by US-based investment banking firm CRT Capital, out of the total 142 SPACs raised in the US till early February 2008, only 30, including Atlas, raised $200 million or more.

As reported in Economic Times

Blackstone Buys Pre-IPO stake in Titagarh Wagons

PE fund Blackstone has picked up a minority interest in Titagarh Wagons for Rs 672 a share in a pre-IPO placement. Blackstone bought 2.35 lakh shares for around Rs 16 crore from the Strategic Ventures Fund (Mauritius). The Mauritius-based company bought equity in Titagarh in July 2005 for Rs 976 a share. But its acquisition cost came down, following an 1:8 bonus issue.

PE fund Blackstone has picked up a minority interest in Titagarh Wagons for Rs 672 a share in a pre-IPO placement. Blackstone bought 2.35 lakh shares for around Rs 16 crore from the Strategic Ventures Fund (Mauritius). The Mauritius-based company bought equity in Titagarh in July 2005 for Rs 976 a share. But its acquisition cost came down, following an 1:8 bonus issue.Blackstone is the fifth major investor to put money in Titagarh Wagons. The other investors include GE Capital Infrastructure (15%), JP Morgan (5%), 2i Capital (6%) and ChrysCapital (6.5%). The Chowdharys, the promoter group, holds a 57% stake.

Kolkata-based Titagarh Wagons will sell 23.8 lakh shares in the primary market through an entirely book-built issue. The company will sell 20.68 lakh fresh shares while two investors will offer 3.15 lakh shares through the issue.

Titagarh Wagons is a leading railway freight wagon manufacturer. It makes railway wagons, balley bridges, heavy earth moving and mining equipment, steel and SG iron castings. It is one of the approved vendors for defence manufacturing as an ‘industry partner’ to the DRDO.

Singpore's BAF Spectrum seed fund enters India

Singapore-based BAF Spectrum Pte Ltd made its first India investment last week in Gurgaon-based Le Travenues Technology Pvt. Ltd running the travel search engine IXIGO.COM

Singapore-based BAF Spectrum Pte Ltd made its first India investment last week in Gurgaon-based Le Travenues Technology Pvt. Ltd running the travel search engine IXIGO.COMThursday, March 13, 2008

Funds Hunt For Land To Ride Commodity SuperCycle

While Equity Markets globally have taken a tumble, commodities are riding on a SuperCycle. Global money is now chasing direct farmlands in search of alpha. Investment banks and hedge funds are mopping up vast tracts of agricultural land around the world, hoping to ride the so-called "commodities supercycle" that has lifted prices of everyday agricultural commodities such as wheat, rice, soybeans and corn to record highs.

While Equity Markets globally have taken a tumble, commodities are riding on a SuperCycle. Global money is now chasing direct farmlands in search of alpha. Investment banks and hedge funds are mopping up vast tracts of agricultural land around the world, hoping to ride the so-called "commodities supercycle" that has lifted prices of everyday agricultural commodities such as wheat, rice, soybeans and corn to record highs.Goldman enters commodities trading through Shriram

The Indian group is transferring its brokerage and distribution services business to Shriram Credit and bringing in Goldman Sachs as a significant minority partner. The deal values the firm at Rs 1,500 crore ($375 million). Goldman Sachs is routing the deal through its 100% Mauritius-based subsidiary GS Strategic Investments.

Foreign investment norms currently do not allow direct investment in a commodity brokerage firm. However, foreign companies can invest in a firm, which in turn owns a separate commodity brokerage entity. The funds would be used for expansion of its existing and proposed businesses of Shriram Credit.

Read the full article on Economic Times

Piramal to demerge R&D - to invite equity partner

Nicholas Piramal India Ltd. will demerge its R&D into a separate company early in March. The partner, likely a pharma MNC with interest in drug discovery, will have at least 10% equity in the research unit, said a senior executive, preferring anonymity.

Nicholas Piramal India Ltd. will demerge its R&D into a separate company early in March. The partner, likely a pharma MNC with interest in drug discovery, will have at least 10% equity in the research unit, said a senior executive, preferring anonymity.L&T-GreatOffshore-Blackstone for ICICIVenture's Tebma Shipyard

According to a ToI article, L&T, shipping company Great Offshore and private equity funds Blackstone, Abraaj Capital and Apax Partners are eyeing a stake in the south-based Tebma Shipyards.

According to a ToI article, L&T, shipping company Great Offshore and private equity funds Blackstone, Abraaj Capital and Apax Partners are eyeing a stake in the south-based Tebma Shipyards.Tebma Shipyards is India’s third largest private ship-building firm after ABG and Bharati Shipyard. Owned largely by ICICI Venture, Tebma, as part of expansion strategy, plans to build a facility in West Bengal.

The 150 acres Rs 500 crore project ($125 million) will be funded by Debt & . ICICI Venture has been approached by various players.Ship-building players earn operating margins of 20-25% helped by 30% export subsidy

The West Bengal shipyard will be Tebma’s third facility, in addition to its Chengalpattu (70km from Chennai) and Malpe in Karnataka. The company will issue fresh equity to the investor and accordingly, ICICI Venture’s stake in Tebma Shipyards will come down, market sources said. The new shareholder is likely to get upto 26% stake for $100 million in Tebma Shipyards. The Rs 400 crore Tebma has an order book position of $400 million.

Similar to publishing firm Infomedia and heat resistant cement products maker ACE Refractories, Tebma too has been a buyout deal by ICICI Venture. Last year, the private equity arm of ICICI Bank bought a 33% stake in Tebma Shipyards and increased its holding to 53% by acquiring additional shares through open offer. Several small investors hold the remaining shares in the company.

The second largest shareholder is Balan, founder of Tebma, who holds about 9% stake.

Two India Centric Funds from Baer Cap

Dubai-headquartered Baer Capital Partners is planning to launch two India-dedicated hedge funds this year.

Dubai-headquartered Baer Capital Partners is planning to launch two India-dedicated hedge funds this year.Sub-Prime Benefits Indian MidCap Companies

This Business Line article reports that Indian Midcap companies have a hit a good time in their Deal Intentions in the US. Reduced profitability, crunch for working capital requirement (this requires a second look though..) & distressed assets on the block are all adding up to increased acquisitions.

This Business Line article reports that Indian Midcap companies have a hit a good time in their Deal Intentions in the US. Reduced profitability, crunch for working capital requirement (this requires a second look though..) & distressed assets on the block are all adding up to increased acquisitions.Monday, March 10, 2008

Sovereign Wealth Funds Come Under Scanner

India has joined the global debat on Sovereign Wealth Funds (SWFs).

India has joined the global debat on Sovereign Wealth Funds (SWFs).Spanish BBVA to enter India through PSB JV

Spanish financial services group BBVA SA has identified India as one of its key markets in Asia and plans to enter the country through a joint venture with a public sector bank (PSB).

Spanish financial services group BBVA SA has identified India as one of its key markets in Asia and plans to enter the country through a joint venture with a public sector bank (PSB).VC Funds: The Problem Of Plenty

It's long been suspected, the problem of plenty. But now it seems real. India is flush with VC funds but not enough worthy enterpreneurs. This, according to Sramana Mitra at Forbes.

It's long been suspected, the problem of plenty. But now it seems real. India is flush with VC funds but not enough worthy enterpreneurs. This, according to Sramana Mitra at Forbes.SIDBI Finanancial Inclusion 2000 Cr. Package

Besides the funds allocated in the Budget, SIDBI will seek participation of private equity players and venture capitalists for injecting risk-bearing equity capital into small and medium enterprises (MSME), the bank's Deputy Managing Director Rakesh Rewari said.

This 2000 Cr. fund is in addition to another Rs.2000 Cr. fund set aside for refinancing to MSME.

"Equity financing is very low in the MSME sector. Of the total finance raised by small firms, only five per cent is contributed towards equity and the rest 95 per cent is in the form of debt," Additional Secretary in the MSME Ministry Jawahar Sircar said. The large industries, on the other hand, manage to meet 45 per cent of their fund requirement in the form of equity, he said.

Earlier this week, SIDBI Venture CEO A K Jaipur said at an MS ME seminar here that availability of equity capital can be increased by promoting more Angel Clubs in the country. "Angel clubs have limited presence in India. There are more than 2,500 in the US compared to only a handful in India," he had said.

Read the full article on Financial Express

Friday, March 7, 2008

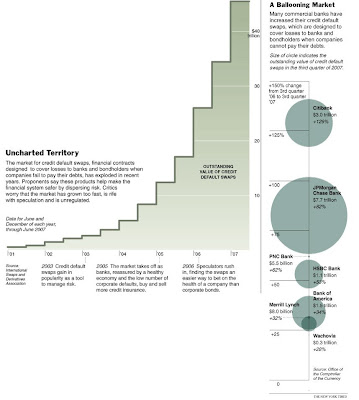

Tata Motors CDS Inching Up on Risk Worries

Tata Motors’ five-year credit-default swaps have more than doubled and its share price fallen 12 per cent since Ford announced the automaker as the preferred bidder for Jaguar and Land Rover on January 3.

Tata Motors plans to raise the 15-month loan from nine banks led by Citigroup and JPMorgan Chase & Co, three people with direct knowledge of the deal said

It will pay less than 2 percentage points more than the London interbank offered rate (Libor) as interest and fees for the loan, the people said. About $2.5 billion will fund the cost of the acquisition and the rest will be used for working capital, the people said. Tata Motors is also talking to Bank of Tokyo Mitsubishi UFJ, BNP Paribas, Calyon, ING Groep, Mizuho Financial Group, Standard Chartered and State Bank of India to arrange the loan, according to the people who declined to be identified because the information was not public.

For more read the article on Business Standard / Bloomberg dated 07.03.2008

VC gets Pass Through Status in Budget

From the Finance Minister’s Union budget speech:

“Venture capital funds are a useful source of risk capital, especially for start-up ventures in the knowledge-intensive sectors. Since such funds enjoy a pass-through status, it is necessary to limit the tax benefit to investments made in truly deserving sectors. Accordingly, I propose to grant pass-through status to venture capital funds only in respect of investments in venture capital undertakings in biotechnology; information technology relating to hardware and software development; nanotechnology; seed research and development; research and development of new chemical entities in the pharmaceutical sector; dairy industry; poultry industry; and production of bio-fuels. In order to promote business tourism, I also propose to allow this benefit to venture capital funds that invest in hotel-cum-convention centres of a certain description and size“

M&A Activity 2007

The PE Pitch : A Different Ball Game

Read it all on ToI

Thursday, March 6, 2008

Goldman Sach's Long bet on India with AMC,NBFC, PE & Wealth Management

After severing it's Kotak ties in 2006, Goldman Sachs is getting 30 year long on India according to GS India's MD & CEO L. Brooks Entwistle. “This is not an outpost. We are here building businesses with a view of the next 30 years.”

GS (India) team of 100 is readying a launch of AMC, followed by Primary Dealership, an NBFC to compete with GE Money & Citi Financial in loans business.

The $770Bn AUM leader is also preparing for Private Wealth Management & Commodities research. It already advises Oil Companies on hedging while it awaits regulatory clearances for Commodity trading.

On the PE front Goldman Sachs has begun chasing Blackstone & Temasek with investments close to $2 billion (Rs8,060 crore) in some 40 Indian firms including OnMobile Global Ltd (recent IPO, Sudhir Gensets Ltd, IRB Infrastructure Developers Ltd and Sigma Electric Manufacturing Corp., besides the NSE Ltd and NCDEX Ltd.

With its research team now closely tracking 75 Indian stocks, its sales force in London, New York, Singapore and Tokyo is aggressively selling Indian equities. L. Brooks Entwistle has appointed HK based Adam Broader as CFO to head the AMC and awaiting SEBI approvals. In the run-up to the AMC launch, GS is in the process of floating Goldman Sachs India Fund, an offshore fund, some time this month.

Read the full story on Mint