Singapore-based BAF Spectrum Pte Ltd made its first India investment last week in Gurgaon-based Le Travenues Technology Pvt. Ltd running the travel search engine IXIGO.COM

BAF is a collaboration between private investors & Singapore government. It's the second investor at the pre-series A (first round) funding stage to enter the Indian market in the last month. Earlier, Singularity Ventures backed by West Asian investors launched operations in the country.

The firm, which typically invests between $500,000 (Rs2 crore) and $1 million, has a dedicated corpus of $14 million. Thus far, it has funded five companies headquartered in Singapore.

Several companies in the online travel space here have received funding in the last two years, including Bangalore-based Yatra Online Pvt. Ltd, Mumbai-based Cleartrip Travel Services Pvt. Ltd and New Delhi-based Makemytrip India Pvt. Ltd.

Over the last 12-18 months, many sources of seed capital have sprung up, including New Delhi-based India Angel Network, Mumbai-based Seedfund and Mumbai Angel Network and Bangalore-based Erasmic Venture Fund.

The Singapore government, under its Business Angel scheme (BAF comes under this), grants $7 million angel money to be invested in start-ups to a group of private investors on the condition that they match the amount with their own capital. As an incentive, the government returns a third of its profits on exits to the investors. It is a hybrid model that combines the Band of Angels mode of investment with government grant distribution. In markets outside Singapore, the angels put in their own money.

The full article can be read on

Mint

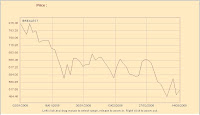

IndiaBulls RealEstate and Unitech Ltd. have put their Singapore REIT plans on hold siting volatile market conditions. DLF may follow too.

IndiaBulls RealEstate and Unitech Ltd. have put their Singapore REIT plans on hold siting volatile market conditions. DLF may follow too.